Frequently Asked Questions The Fixed Income Money Market and Derivatives Association of India

Contents:

Transfer stamp duty remains high in many states and is probably the biggest deterrent for trading in debentures in physical segment, resulting in lack of liquidity. FRBs or Floating Rate Bonds comes with a coupon floater, which is usually a margin over and above a benchmark rate. E.g, the Floating Bond may be nomenclature/denominated as +1.25% FRB YYYY . +1.25% coupon will be over and above a benchmark rate, where the benchmark rate may be a six month average of the implicit cut-off yields of 364-day Treasury bill auctions.

Planned initiatives include providing training and certification to members, setting up a dispute resolution mechanism as well as creating new products and addressing the attendant details. As a member, you have the opportunity to participate in all of FIMMDA’s activities and contribute to the development of the Indian debt markets. These are the dated-securities issued only by the central government. ’Gilt Securities’ are issued by the RBI, the central bank, on behalf of the Government of India. Being sovereign paper, gilt securities carry absolutely no risk of default. Gilt-edged are high graded low-risk investment instruments issued by thegovernment.

GREEN BONDS: DEBT FINANCING OPTION FOR GREEN PROJECTS

The point is that you are taking a big portfolio risk by sticking to government bonds. • Securities are issued for short term as well as long term. Short term securities with maturity less than 1 year are called Treasury Bills (T-Bills) while long term securities with a maturity of 1 year or more are called Government Bonds or dated securities. Short term government securities are Treasury bills. There are three main treasury bills in India – 91 day, 182 day and 364 day. The difference between coupon rate and yield arises because the market price of a security might be different from the face value of the security.

UK Debt Management Office UK Regulatory Announcement: Issue … – Business Wire

UK Debt Management Office UK Regulatory Announcement: Issue ….

Posted: Wed, 26 Apr 2023 14:21:00 GMT [source]

The loans are of short-term duration varying from 1 to 14 days. The money that is lent for one day in this market is known as “Call Money”, and if it exceeds one day it is referred to as “Notice Money”. Term Money refers to Money lent for 15 days or more in the InterBank Market. Long-term securities typically offer more return than short-term securities because investors usually prefer to lend money for shorter terms. Hence money lent out for longer terms will have a higher yield.

In respect of Demat Debt instrument due date is known from ISIN Number of the security. These are issued in denominations of Rs.5 Lacs and Rs. 1 Lac thereafter. Financial Institutions are allowed to issue CDs for a period between 1 year and up to 3 years.

What is RBI’s Prompt Corrective Action (PCA) Framework?

FIMMDA has issued operational and documentation guidelines, in consultation with Reserve Bank of India, on Commercial Paper for market. 2.Those who can only lend Financial institutions-LIC, UTI, GIC, IDBI, NABARD, ICICI and mutual funds etc. Overnight interest rate swaps are currently prevalent to the largest extent. They are swaps where the floating rate is an overnight rate and the fixed rate is paid in exchange of the compounded floating rate over a certain period.

Stay updated with the latest Current affairs and other important updates regarding video Lectures, Test Schedules, live sessions etc.. Interviewmania is the world’s largest collection of interview and aptitude questions and provides a comprehensive guide to students appearing for placements in India’s most coveted companies. Religious and Charitable trusts are regulated by some of the State governments of the states, in which these trusts are located.

That practise has stopped with the collapse of the Bretton Woods system but the name has remained. The gilt edged securities refers to government securities encompass all Bonds & T-bills issued by the Central Government, state government. These securities are normally referred to, as “gilt-edged” as repayments of principal as well as interest are totally secured by sovereign guarantee. Long-term debt securities issued by the Government of India or any of the State Government’s or undertakings owned by them or by development financial institutions are called as bonds. Instruments issued by other entities are called debentures. The difference between the two is actually a function of where they are registered and pay stamp duty and how they trade.

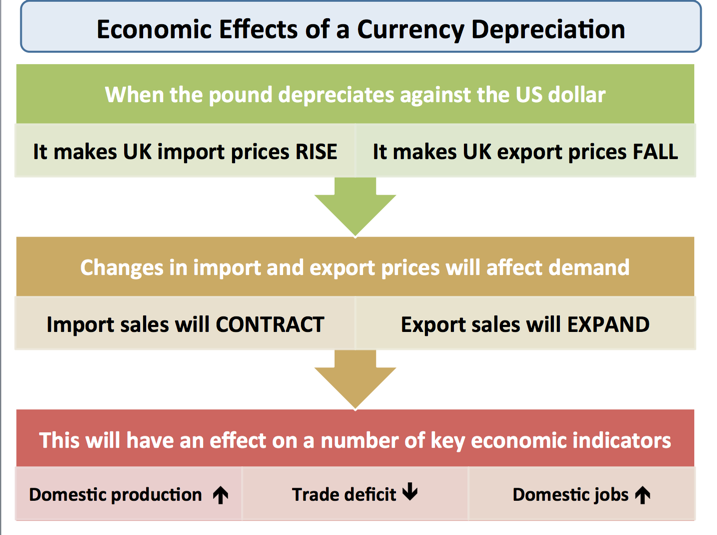

Options are one-way contract where one party has the right but not the obligation to trade in a particular asset at a particular price on a pre-determined date/dates or in a particular time interval. Long term maturity above 1 year and up to 40 years. A fall in the exchange rate that reduces the value of a currency in terms of other currencies is called ______.

Download more important topics, notes, lectures and mock test series for UPSC Exam by signing up for free. Debentures enable investors to reap the dual benefits of adequate security and good returns. Unlike other fixed income instruments such as Fixed Deposits, Bank Deposits they can be transferred from one party to another by using transfer from.

Difference between Consumer Price Index (CPI) and Wholesale Price Index (WPI)

Here, many are saying that a gilt bond is low-risk, but that is not so. One very large and typical risk is that the value of currency will decrease by the maturation time. In these cases, the government should typically devalue the bond by increasing the interest rate, but often it doesn’t happen. In India, the Central Government issues both treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans . Technically however, the term refers to bonds issued by the UK Government – debt securities issued by the Bank of England on behalf of Her/ His Majesty’s Treasury.

Understanding Our Investment Journey – Moneylife

Understanding Our Investment Journey.

Posted: Mon, 10 Apr 2023 07:00:00 GMT [source]

Short term securities are usually called Treasury Bills. When RBI buys a Government bond in the open market, it pays for it by giving a cheque. This cheque increases the total amount of reserves in the economy and thus increases the money supply. Qualitative tools include persuasion by the Central bank in order to make commercial banks discourage or encourage lending which is done through moral suasion, margin requirement, etc. A Constituent Subsidiary General Ledger Account is a service provided by Reserve Bank of India through Primary Dealers and Banks to those entities who are not allowed to hold direct SGL Accounts with it.

Since coupon payments are calculated on the face value, the coupon rate is different from the implied yield. Are there risks of investing in bonds issued by the government? Here are 5 bond investing risks of government bonds that you were probably not aware of.

- Short term government securities are Treasury bills.

- Gilt-edged term is used mostly in markets where government securities and bonds are traded.

- TheBihar Police ConstableNotification 2023 is expected to be released soon.

- The issuing institutions typically boast strong track records of consistent earnings that can cover dividend or interest payments.

- Qualitative tools include persuasion by the Central bank in order to make commercial banks discourage or encourage lending which is done through moral suasion, margin requirement, etc.

- +1.25% coupon will be over and above a benchmark rate, where the benchmark rate may be a six month average of the implicit cut-off yields of 364-day Treasury bill auctions.

But if you use up the interest for other purposes then the actual yield on the bond will be lower than the YTM that is claimed. That is the risk of not reinvesting your interest flows at the YTM and is popularly called the reinvestment risk. Most investors in bonds are actually not aware of this risk, but it is a very important risk and needs to be highlighted.

What is short selling in the stock market?

This account provides for holding of Central/State Government Securities and Treasury bills in book entry/dematerialized form. Individuals are also allowed to hold a Constituent SGL Account. G-Secs are usually referred to as risk free securities. However, these securities are subject to only one type of risk i.e., interest-rate risk. Subject to changes in the over all interest rate scenario, the price of these securities may appreciate or depreciate. Cum-interest means the price of security is inclusive of the interest accrued for the interim period between last interest payment date and purchase date.

The relationship between time and yield on a homogenous risk class of securities is called the Yield Curve. The relationship represents the time value of money – showing that people would demand a positive rate of return on the money they are willing to part today for a payback into the future. It also shows that a Rupee payable in the future is worth less today because of the relationship between time and money. A positive yield curve, which is most natural, is when the slope of the curve is positive, i.e. the yield at the longer end is higher than that at the shorter end of the time axis.

Commercial Papers are short term borrowings by Corporates, FIs, PDs, from Money Market. Callable securities are those which can be called by the issuer at a predetermined time/times, by repaying the holder of the security a certain amount which is fixed under the terms of the security. FIMMDA addresses issues that affect the entire industry. Some of the work done in past pertains to issues like legal and accounting norms, documentation requirements and valuation methodologies.

It means if the company is unable to repay the debentures as per the terms of issue the debenture holders can move the court and release their money by getting assets of the company sold. These are securities and bonds issued by RBI on behalf of government and less these bonds have predetermined or fixed maturity date. The Seminar comprised of a talk by Vineet Nahata, one of the masters of the securities market and certainly the prime mover in the Guilts segment. A Repo deal is one where eligible parties enter into a contract with another to borrow money against at a pre-determined rate against the collateral of eligible security for a specified period of time. Indian Repo Market is governed by Reserve Bank of India. At present Repo is permitted between permitted 64 players against Central & State Government Securities (including T-Bills) only at Mumbai.

Don’t chuck money at foreign companies Tim Congdon – The Critic

Don’t chuck money at foreign companies Tim Congdon.

Posted: Wed, 12 Apr 2023 23:12:40 GMT [source]

Commercial Papers are short-term unsecured borrowings by reputed companies that are financially strong and carry a high credit rating. These are sold directly by the issuers to the investors or else placed by borrowers through agents / brokers etc. The call money market is an integral part of the Indian Money Market, where the day-to-day surplus funds are traded.

- The idea behind these bonds is to make them attractive to investors by removing the uncertainty of future inflation rates, thereby maintaining the real value of their invested capital.

- The term government securities encompass all Bonds & T-bills issued by the Central Government, state government.

- This is popularly called the hidden risk of investing in government bonds.

- It basically measures the total income earned by the investor over the entire life of the Security.

Gilt-edged securities are high-grade investment bonds offered by governments and large corporations as a method of borrowing funds. The issuing institutions typically boast strong track records of consistent earnings that can cover dividend or interest payments. In many ways, these are the next safest bonds to US Treasury securities. Long term government securities are known as government bonds or dated securities. They have a maturity period of five years, ten years, fifteen years etc. PFIs offer bonds with different features to meet the different needs of investors eg.

To function as an arbitrator for disputes, if any, between member institutions. To provide training and development support to dealers and support personnel at member institutions. Gilt edged market means the market of Government securities.

Earlier, it used to strictly control interest rates through a directed system of interest rates. Each type of lending activity was supposed to be carried out at a pre-specified interest rate. Over the years RBI has moved slowly towards a regime of market determined controls. RBI controls the issuance of new banking licenses to banks. It controls the manner in which various scheduled banks raise money from depositors.

This process is continued for all securities across the time series. If represented algebraically, the process would lead to an nth degree polynomial that is generally solved using numerical methods. 2) Through private placements to large institutional investors.

Reserve Bank of India has framed a time schedule to phase out the second category out of Call Money Market and make Call Money market as exclusive market for Bank/s & PD/s. Maturity indicates the life of the security i.e. the time over which interest flows will occur. To assume any other relevant role facilitating smooth and orderly functioning of the said markets.

Gilt-edged securities are bonds issued by some national governments. The term is of British origin, and then referred to the debt securities issued by the Bank of England on behalf of His/Her Majesty’s Treasury, whose paper certificates had a gilt edge. Securities are issued for a fixed period of time at the end of which the principal amount borrowed is repaid to the investors. The date on which the term ends and proceeds are paid out is known as the Maturity date.