Content

529 plans offer federal tax-free growth and tax-free withdrawals for qualified education expenses. Some states may also offer a full or partial tax credit or deduction to residents who contribute to their state’s plan or, sometimes, to any plan. Parents — and grandparents, family friends, or other loved ones — can sock away up to $15,000 per year, per child, in the tax-advantaged college savings account known as a 529. The traditional IRA allows for a tax deduction, which effectively decreases your taxable income for the year the contribution is made.

No matter what your goals are, deciding to invest in your future is a surefire way to build financial flexibility over time. After all, increasing your savings and reducing debt isn’t just about getting “rich.” Investing is all about having options to pursue what is most important to you in life. As your goals and circumstances change, revise your investment strategy using the questions outlined at the introduction of this article, but stay committed to a long-term outlook.

“For most people, for the average person, the S&P 500 is going to be the best bet,” he said. If I had to invest $10,000 right now, I would go with a limited number of dividend growth stocks. In this article, I’m giving you five stocks that each pay a dividend with satisfying dividend growth. This is not necessarily a priority when holding stocks for just five years. However, I want to give you stocks that I would hold way beyond the five-year holding period and prove that the theories supporting this strategy do work indeed. This includes incorporating a mix of strong potential returns and a low likelihood of high losses during these five years.

Is 10k good to start investing?

Bond funds are good for investors who want a diversified portfolio of bonds without having to analyze individual bonds. In addition, a short-term fund provides the least amount of risk exposure to changing interest rates, so rising or falling rates won’t affect the price of the fund too much. They’re also good for individual investors who don’t have enough money to buy individual bonds, and the risk-averse should like them, too.

As an investment, gold usually pops up on people’s radars during times of fear and uncertainty. Studies have shown that over time index funds outperform the vast majority of actively managed funds. To think that you can outperform the index over long time periods would mean outperforming some of the best active fund managers out there — pros whose full-time focus is stock picking. Armed with this knowledge, you can move forward with a much clearer vision of how to start working toward your financial goals. However, to meet your desired financial goals, you must know how to make your money work for you.

Ways to Invest $10,000

Take some time now, before you make any money moves, to think about where you ultimately want to be. Different life goals often call for different financial strategies. If you will be staying invested for the long term (at least five to 10 years), and you aren’t interested in babysitting your money, an index fund in a brokerage account is worth considering.

My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Don’t Fight the Fed

Online companies like Mainvest specialize in crowdsourcing private company investments and may have the perfect business for you to invest in your area for as little as $100 or $1,000. Researching local businesses before you invest offers insight into how well they’re doing financially. If you know, there’s strong revenue growth, that’s a good indicator that the business might be successful over the long haul. Investing in local businesses is a great way to keep your money in the community- and it can also yield outstanding returns.

This first is a combination of low rates and fiscal easing focused on delivering full employment, higher wages and reduced inequality, rather than the inflation targeting of the last 25 years. Second, inflation is now welcomed by policymakers, not cursed. Full employment and higher inflation boosts the pricing power of companies, which helps deliver stronger profits. In this environment, Asian equities stand out as a relative bargain. In recent years, Japanese stocks have traded at a discount to the U.S., and that discount is particularly large today. The Topix index is trading at approximately 1.3 times book value, vs. more than 3 times for the S&P 500.

CREDITDONKEY INC is not an investment client of Personal Capital Advisors Corporation or Empower Advisory Group, LLC. Fundrise, LLC (“Fundrise”) compensates CreditDonkey Inc for new leads. Write to Kim P at Follow us on Twitter and Facebook for our latest posts. Another change with a large ROI is updating the home’s curb appeal. You may even get bonus points for energy efficient changes you make.

Short-term investments are usually pretty safe, especially relative to longer-term investments such as stocks or stock funds. These features mean that your money will not be at risk and will be accessible when you need to use it, which is one of the major reasons to have a short-term investment. In contrast, you can earn a higher return on long-term investments but must endure more short-term volatility. If you need that money, though, you might have to sell a long-term investment at a loss to access it fully. A money market mutual fund invests in short-term securities, including Treasurys, municipal and corporate debt, as well as bank debt securities.

The Best Way to Invest $10,000 in 2023

The rest of us would eventually like to retire, and investing in a retirement account is an investment in your future. A self-directed brokerage is designed for people who want to manage their own investments. You need to be comfortable choosing which stocks to invest in, and you need to be willing to accept any losses.

Starting with valuations, European equities trade at 13 to 14 times next year’s earnings, which is cheap relative to the almost 18 times next year’s earnings for the S&P 500. Dividend yields are approximately 3.5% for the continent and 4.5% for the U.K., almost double the 1.8% on the S&P 500. As for the companies, while not cheap at nearly 25 times trailing earnings and 22 times next year’s earnings, the sector’s valuation premium is justified. The forces of supply and demand dictate the price of semiconductors as well as oil, with the lowest marginal cost producers having a distinct advantage over the competition. The last time markets ignored the cyclicality of technology was in the late 1990s, a rough period for the most overvalued stocks.

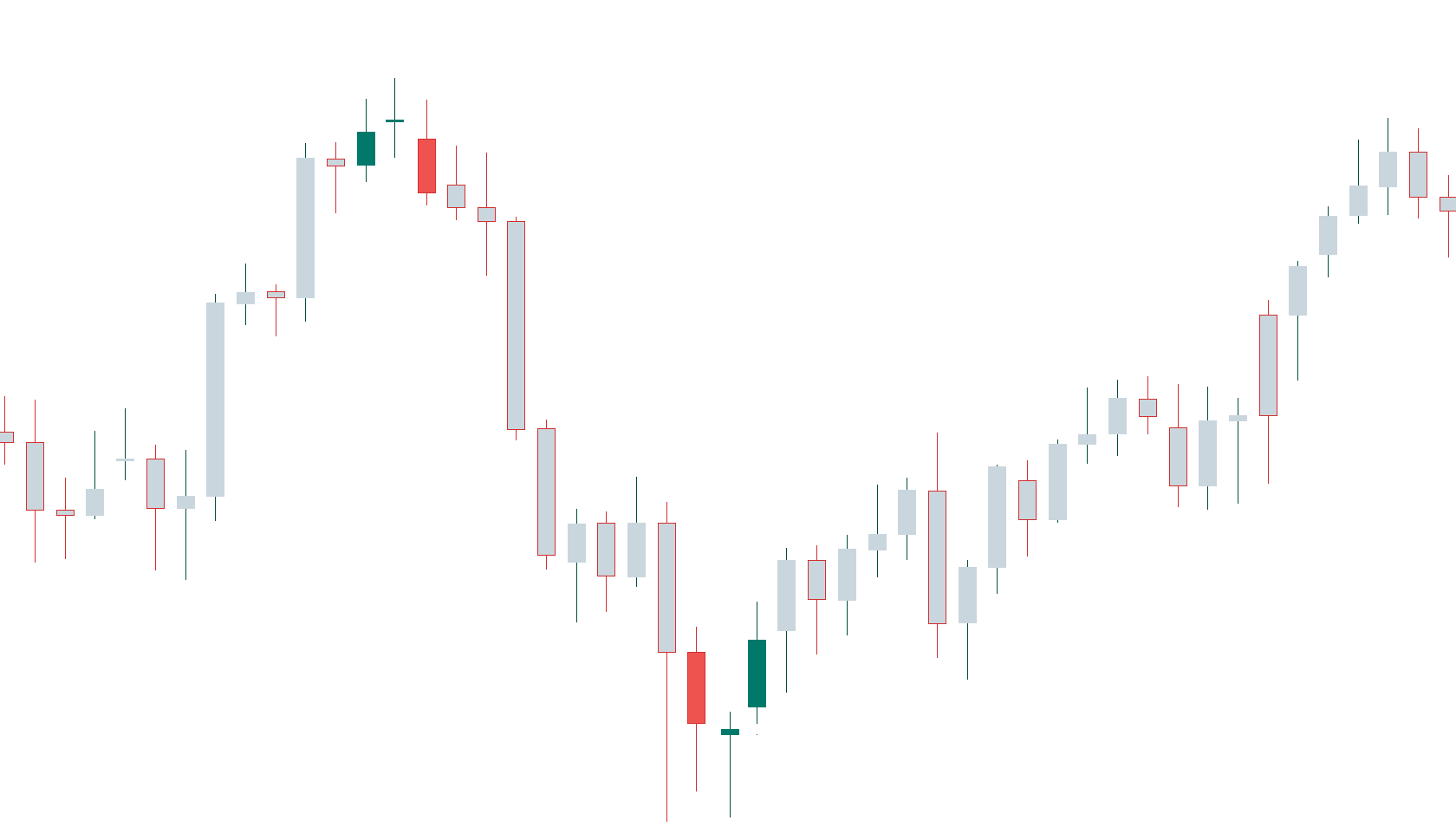

A defining feature of 2018 has been how the Trump tax cuts have helped boost U.S. GDP to be consistently faster than other developed economies. However, GDP growth of 4.1 percent in the year’s second quarter will likely be “peak growth” for this cycle. Our early-warning indicators suggest https://g-markets.net/helpful-articles/trading-the-morning-star-candlestick-pattern/ that activity is now likely to slow in most major economies through the second half. Even though the recovery may be muted, it can still be broad — nearly all purchasing manager index surveys (which measures manufacturing activity) published around the world in recent months have risen.

Knowing why you’re investing in the first place will help you stay motivated so that you can eventually reach your goals. A small percentage of people are lucky enough to be doing jobs they genuinely love. These people plan to work as long as possible because their job is also their passion.

- If you have a passion for the DIY, consider starting a blog.

- Treasury yields unlikely to rise above 2% in the coming year, relative valuations should also continue to support equities.

- For the majority of investors, index funds are the best investments with 10k.

- In fact, major bathroom and kitchen remodels often don’t have a large return on investment.

- I went with 30% energy using the Energy ETF, and I used the tech-heavy ETF (QQQ).

We’re looking to raise exposure to stocks and sectors geared to stronger economic activity, higher inflation and increased liquidity. Our conclusion is that it will be dangerous to fight the Fed. If you are fully invested, think about cashing in some of the gains seen in recent weeks. We suggest taking refuge in government bonds via an ETF such as the iShares 20+ Year Treasury Bond ETF (TLT). If you want to retain some exposure to equities, focus on quality stocks, perhaps using an EFT such as the iShares MSCI USA Quality Factor ETF (QUAL).

Assuming buyers will pay for efficacious drugs, then the prognosis for the more innovative pharmaceutical companies is good. With rising disposable income per capita, China’s demand for health care, especially top-tier hospital services, exceeds supply. The central government recognizes the problems and aims to relieve congestion at the most reputable public hospitals by welcoming private capital into the industry.